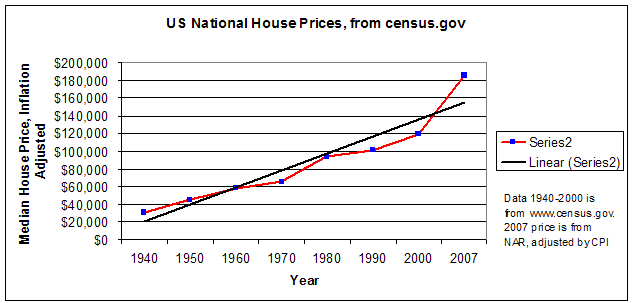

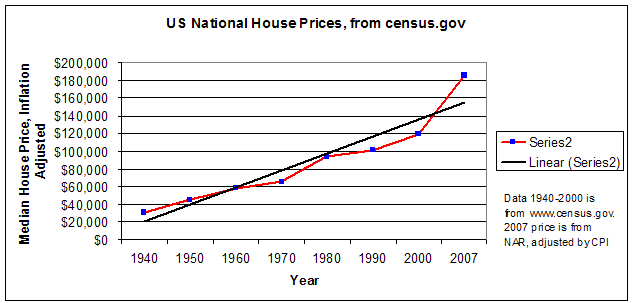

Housing Prices, 1940-2007

In the case of The People vs. The Culprits behind the Crash, we find:

Government: Guilty as Charged

Capitalism: Not Guilty

I don't claim to be an expert on these matters. What I don't understand is how anyone can conclude that when the economy crashed after one of the biggest government expansions of all time, it must be a problem with markets. I also sense that a big part of the story is left out in the current discussions, in the media as well as on the web.

The Housing Bubble

The bubble that built over the last few years was probably a natural part of the business cycle. How bad was it?

Housing Prices, 1940-2007

According to National Association of Realtors, the median, national house price in 2007 was $223,500. In 2000 dollars, that corresponds to $185,500, using the CPI. I use CPI because that's what the Census Bureau used to adjust its numbers on the graph. According to the trendline, it should have been ~$140,000. That's a 35% difference, or a growth of %55 percent instead of %15 percent, from the 2000 level. As housing bubbles go, that's bad, but not calamatous.

Lots of people have speculated on the sub-prime mess. I'll instead focus on the expansionary fiscal policies leading up to the crash.

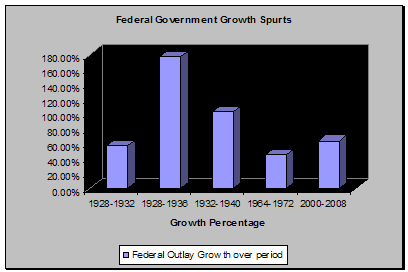

Government Growth

Under the Bush administration, the Federal government has undergone one of the largest expansions in its history.

One trillion dollars. Sixty five percent. You have to go back to the Hoover and FDR administrations to find a period of more growth.

Federal Government Growth

Periods, measured as share of growth over outlays in first year of each period. WWI and WWII periods were omitted.

Only the FDR administration grew the Federal government more than Bush. (The second bar, representing the largest eight-year growth spurt in peace-time, probably ever, covers the Hoover and the first FDR terms). Not even the Lyndon B. Johnson administration, combined with the first Nixon term, which includes the Vietnam war escalation and Great Society spending, resulted in more government expansion.

Treasury Bills

When the government adds one trillion dollars to its budget, two trillion dollars to its debt, and issues treasury bills every year equivalent to, say, the total size of Wal-Mart and Boeing combined, something bad is bound to happen. They should not have been surprised that something bad really did happen.

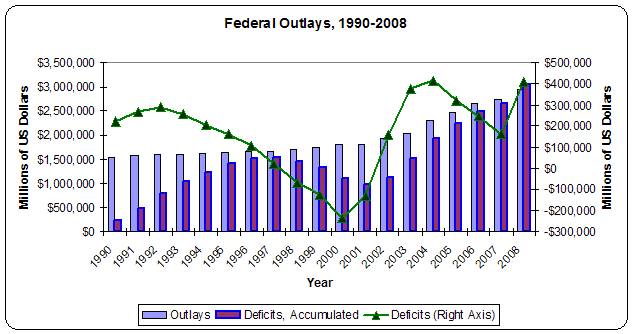

Federal

Outlays, Deficits and Accumulate Deficits, 1990-2008. Accumulate Deficits

is over this period only. Total debt at the end of 2007 was over

$9 trillion.

Stressing the importance of the scale involved: just from 2004-2008, the Feds issued debt equivalent to ten Citigroups. Wrap your mind around this. The largest financial corporation in the largest economy in the world is puny compared to the debt that the Federal government is issuing.

Not being an economist, I believe it's well established that the Treasury bills compete with bonds, and that bonds fuel the credit market. Given this, it seems impossible that such an enormous infusion of Treasury bills could not impact the credit markets.

What If?

What if the credit market had not been squeezed by Federal financial policy? The housing market would still have burst, and we might still have had a recession, but the fall-out would have been minor. The Financial Meltdown of 2008 would not have occurred.

The irony of this is that they issue even more Treasury bills in response to the crisis.

What if they had done the opposite? The last time the Federal government responded to an economic crisis by slashing spending was in 1921. It worked. The depression in 1921 was quite severe, with a twelve percent unemployment rate and a sixteen percent contraction. The Harding administration responded by slashing Federal spending by twenty percent in 1921 and another 35 percent in 1922. The economy recovered immediately: unemployment vanished, and the economy grew seventeen percent in 1922, and continued on a healthy growth path until a mild recession in 1927.

Conclusion

When you issue Treasury bills like propaganda notes, expect a crisis of some sort. If there hadn't been a housing asset implosion issue, there would have been another event to nudge the financial markets and bring the strain to bear.

The Treasury bills infusion is not the whole story, but it is missing from the debate. We hear all about the housing bubble, sub-prime loans, deregulation (although it's unclear what has been deregulated), over-regulation (Sarbanes-Oxley, SEC's ruling against shorts, Fannie and Freddie governance), greedy banks, greedy home owners, the Feds did a good job under the circumstances, the Feds botched it.

How can the largest component of the US financial markets, by far, be left out?

Sources

| From The Onion |

In The Know: Should The Government Stop Dumping Money Into A Giant Hole? |

Other stuff by Henri Hein: